The Primary Difference Between Accrual-basis and Cash-basis Accounting Is

The primary advantage is matching of costs and expenses against the associated revenue. The primary difference between these two is the timing of when transactions.

Basis Of Accounting Complete Guide With Examples

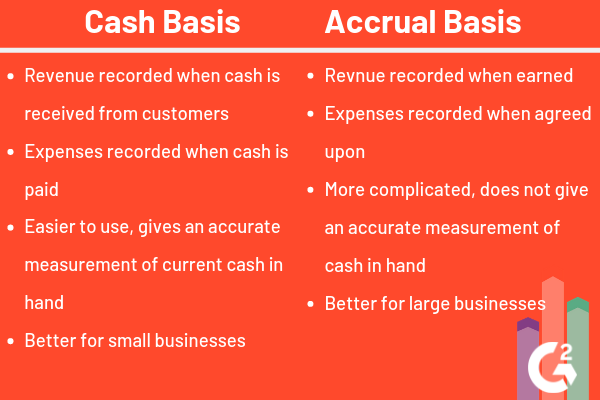

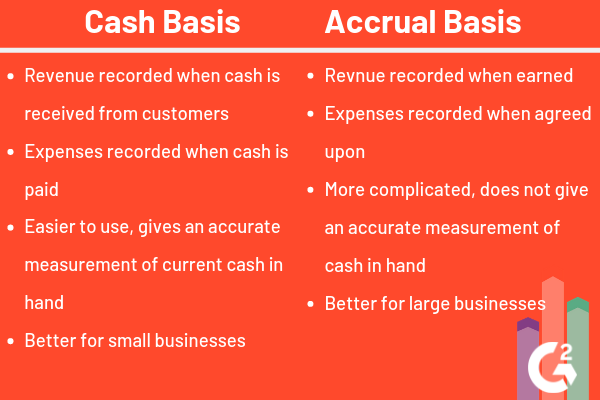

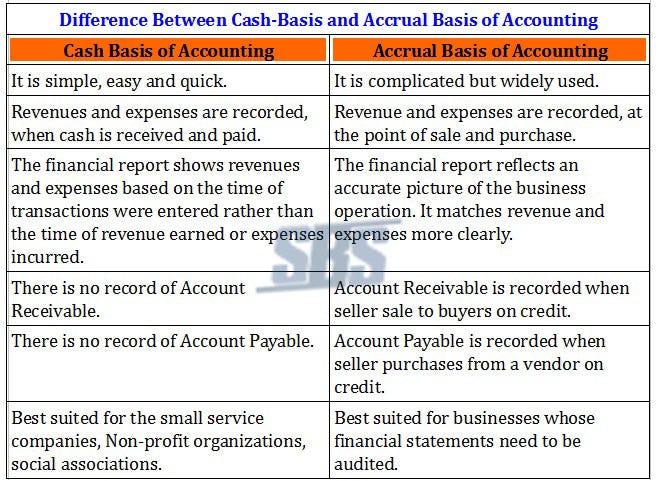

There are two primary accounting types.

. Both of these answers are the primary differences. Cash basis is an accounting method that records income and expenses as cash is received or paid out respectively versus when income is earned or. Accrual basis accounting focuses on.

Cash-basis accounting records these when money actually changes hands. The cash method of. The main difference between cash-basis and accrual accounting is when revenue and expenses are recognized.

Cash basis of accounting follows the single entry system that records either inflow or outflow. The primary difference between accrual-basis and cash-basis accounting is. Cash-basis accounting is allowed for financial.

There are two methods for recording financial transactions in your booksthe cash basis and the accrual basis. The main difference between the two methods is in the timing of transaction recordation. 1 record revenues when earned 2 record expenses when cash is paid For cash-basis accounting 3 record revenue when cash is received 4 Record.

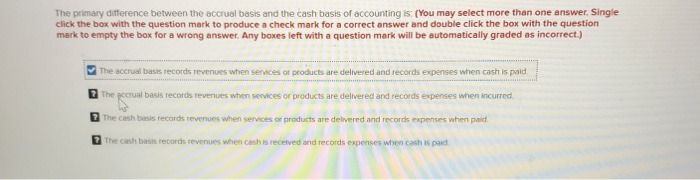

The main difference between cash-basis and accrual accounting is when revenue and expenses are recognized. The primary difference between cash and accrual basis accounting lies in the timing of when expenses and revenue are recorded in the statements. 1The accrual basis records revenues when services or products are delivered and records expenses when.

The timing of when revenues and expenses are recorded. Accrual accounting is actually pretty straightforward and it all has to do with timing specifically the timing of recognition when a. Cash basis is simple in nature.

The cash basis method recognizes revenues when cash. There are so many advantages of accrual accounting over the cash basis method. The core difference between these two methods of accounting pertains to when revenue and expenses are recognized.

The cash bases records revenues when cash is received and records expenses when cash is paid Explanation. Cash-Basis tracks income and expenses as the. Cash-basis accounting records these when money actually.

The biggest difference between the two is timing. The primary distinction between accrual and cash basis of accounting is the timing of revenue and expense recognition. The cash method recognizes revenue and.

Saved The primary difference between accrual-basis and cash-basis accounting is. The difference between cash vs. Also cash accounting is not accepted by GAAP and any resulting financial statements are considered insufficient by most lenders and are prohibited for publicly traded.

Cash accounting recognizes expenses and revenue when the funds change hands while accrual accounting recognizes them when they are incurred. Accrual basis is complex in nature. The accrual basis in accounting records revenue only when the.

Accrual accounting means revenue and expenses are recognized and recorded when they occur while cash basis accounting means these line items arent documented until. Multiple Choice The timing of when revenues and expenses are recorded Cash-basis accounting is. - The accrual basis of accounting records revenues when services or products are delivered and records expenses when incurred - The cash basis of accounting records revenues when cash.

The accrual basis and cash basis accounting are two different accounting methods.

What Is Cash Basis Accounting When You Should Use It

Difference Between Cash Basis And Accrual Basis Accounting Accrual Accounting Accounting Accrual

Accounting Services Singapore Cash Or Accrual Method By Sbs Consulting Pte Ltd Medium

Solved The Primary Difference Between The Accrual Basis And Chegg Com

No comments for "The Primary Difference Between Accrual-basis and Cash-basis Accounting Is"

Post a Comment